Uncover why the Mehta family filed an FIR against HDFC Bank CEO Sashidhar Jagdishan, tied to Lilavati Trust allegations, while the bank denies the claims. Get full details, timelines, and implications.

🚨 What Happened & When

-

June 8, 2025: The Lilavati Kirtilal Mehta Medical Trust (Lilavati Trust), controlled by the Mehta family, filed a First Information Report (FIR) with Mumbai’s Bandra police against HDFC Bank CEO Sashidhar Jagdishan and eight others. The trust alleged “serious financial fraud, criminal conspiracy, abuse of fiduciary position, evidence tampering, and obstruction of justice”economictimes.indiatimes.com+15livemint.com+15thehansindia.com+15.

-

Allegation stems from ₹2.05 crore allegedly paid to Jagdishan by a former trust member—purportedly to harass a trustee’s father—and documented in a handwritten cash diarym.economictimes.com+5indiatoday.in+5m.economictimes.com+5.

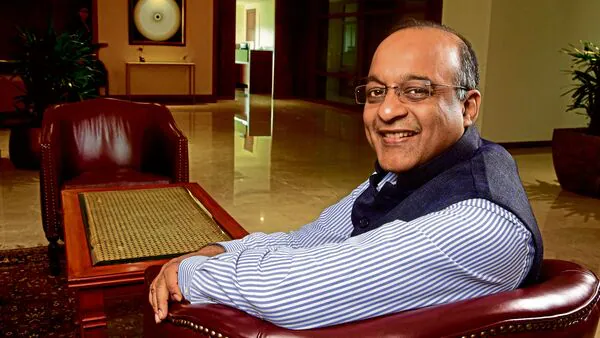

👤 Who Is Sashidhar Jagdishan?

-

Joined HDFC Bank in 1996; climbed from finance manager → Head of Finance (1999) → CFO (2008) → MD & CEO (October 2020)thehansindia.com+11indiatoday.in+11indiatimes.com+11.

-

Education: Bachelor’s in Physics (University of Mumbai), Master’s in Money, Banking & Finance (University of Sheffield), CA from ICAIm.economictimes.com+4livemint.com+4indiatoday.in+4.

-

RBI approved extension as MD & CEO until October 26, 2026m.economictimes.com+14livemint.com+14indiatoday.in+14.

🧩 Allegations by the Trust

The Lilavati Trust contends that:

-

Jagdishan and others misappropriated funds to harass a trustee’s family.

-

FIR was filed under court orders dated May 30, 2025hindustantimes.com+15indiatoday.in+15tribuneindia.com+15indiatimes.com+2m.economictimes.com+2indiatimes.com+2.

-

Trust demanded his immediate suspension and action from regulators like RBI and SEBIm.economictimes.com+1thehansindia.com+1.

🏛️ HDFC Bank’s Firm Response

-

Calls FIR “malicious and baseless”, describing it as a retaliatory tactic aimed at derailing its debt recovery effortsrediff.com+7livemint.com+7indiatimes.com+7.

-

Clarified that Splendour Gems Ltd., owned by the Mehtas, took loans in 1995, defaulted in 2001, and still owes approximately ₹65.22 crore (incl. interest) as of May 31, 2025m.economictimes.com+11english.mathrubhumi.com+11tribuneindia.com+11.

-

Asserts that legal avenues have been exhausted by the Mehtas, and filing an FIR is intended to pressure the bankeconomictimes.indiatimes.com+15livemint.com+15english.mathrubhumi.com+15.

-

Bank commits to “continue all lawful remedies to recover public funds” and defend its reputationindiatimes.com+8livemint.com+8thehansindia.com+8.

🔍 Stakeholder Implications

-

Investor Sentiment: News is stirring market attention—HDFC Bank’s shares closed 1.42% higher at ₹1,978.70, with volatility expectedm.economictimes.com+2livemint.com+2thehansindia.com+2.

-

Regulatory Oversight: The case places governance processes and fiduciary responsibility under fresh scrutiny.

-

Legal Proceedings: Expect prolonged litigation: police investigations, potential regulatory interventions, and countersuits.

💡 Key Takeaways

| Item | Summary |

|---|---|

| Nature of Charges | FIR alleges ₹2.05 crore received to harass a trustee’s family. |

| Bank’s Defense | Terms the FIR “malicious,” tied to stalled debt recovery. |

| Outstanding Dues | Splendour Gems still owes ₹65.22 crore, per HDFC. |

| Market Reaction | Share movement volatile; watch for investor sentiment. |

| Next Steps | Legal probes, regulatory scrutiny, and possible escalation. |

🧠 What to Watch Going Forward

-

Investigation Updates: Mumbai police action on the FIR will be pivotal.

-

Regulatory Involvement: RBI and SEBI responses to the FIR and bank’s counterclaims.

-

Legal Counters: HDFC’s probable pursuit of defamation or injunctions.

-

Market Response: Continued stock fluctuations based on news flow.

✅ Conclusion

The high-profile FIR filed by the Mehta family against HDFC Bank CEO Sashidhar Jagdishan reflects a complex convergence of long-standing loan dispute, philanthropic institution allegations, and corporate governance ramifications. With ₹65+ crore at stake and leadership under fire, the developments demand close tracking—from legal battles to boardroom repercussions and market signals.

Also Read: How-shark-tank-india changed-indian startups forever?